Customer Lifetime Value: Understanding The True Worth Of Your Customers

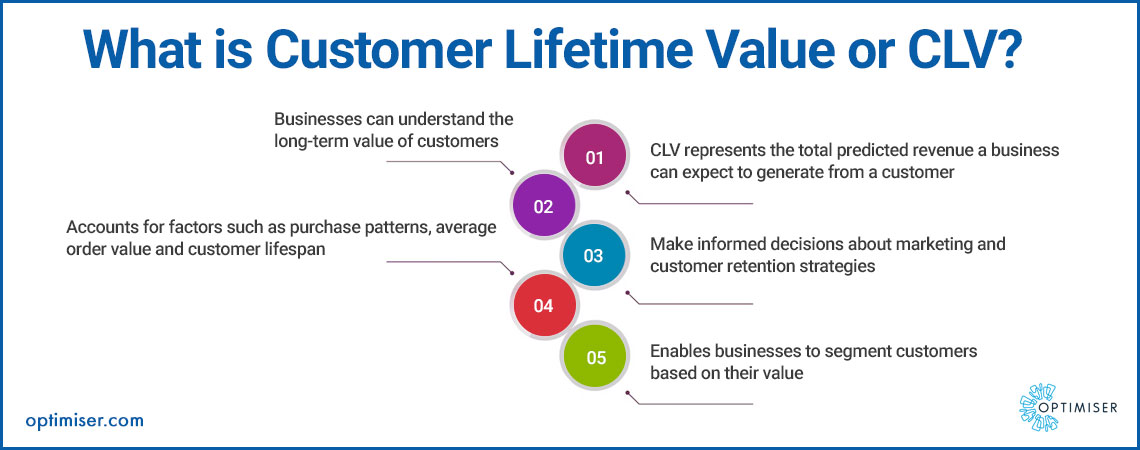

CLV stands for Customer Lifetime Value. It is a crucial metric that can be calculated using CRM software. It is used in business to estimate the monetary value a customer brings to a company over the entire duration of their relationship.

CLV takes into account not only the initial purchase but also the repeat purchases, loyalty, and potential referrals made by the customer. By analysing CLV, businesses can gain insights into customer profitability and make informed decisions regarding marketing strategies, customer acquisition costs, retention efforts, and overall business growth.

By focusing on maximising CLV, companies can create sustainable growth and competitive advantage in their respective markets.

Why Is CLV Important?

CLV is important because it provides valuable insights into customer profitability and helps businesses make strategic decisions. By understanding the lifetime value of a customer, companies can allocate resources effectively, optimise marketing efforts, and improve customer retention strategies.

CLV helps identify the most valuable customers, enabling businesses to prioritise their efforts and provide personalised experiences. It also aids in setting appropriate pricing strategies, customer acquisition costs, and customer service investments.

What Are The Benefits Of CLV?

- Strategic resource allocation: CLV helps companies allocate their resources effectively. By identifying high-value customers, businesses can invest more in marketing, customer service, and retention efforts for those customers, maximising their profitability.

- Improved marketing strategies: CLV calculated through cloud crm software helps optimise marketing campaigns by identifying customer segments that have the highest potential for long-term value. Businesses can tailor their marketing messages, offers, and channels to resonate with these segments, leading to higher conversion rates and customer engagement.

- Enhanced customer retention: CLV analysis highlights the value of customer retention. By understanding the long-term value of customers, businesses can develop targeted retention strategies to reduce churn and increase customer loyalty. This may involve personalised offers, loyalty programs, or proactive customer support.

- Pricing optimisation: CLV analysis aids in setting appropriate pricing strategies. By understanding the value customers bring over their lifetime, businesses can determine optimal price points that balance customer satisfaction and profitability. This may involve offering tiered pricing, upselling, or cross-selling strategies.

- Customer-focused decision-making: CLV shifts the focus from short-term transactions to long-term customer relationships. It encourages businesses to make decisions that prioritise customer satisfaction and loyalty, ultimately leading to increased customer lifetime value and repeat business.

- Competitive advantage: Businesses can differentiate themselves from competitors by leveraging CLV. Understanding customer behaviour and preferences allows companies to deliver personalised experiences, targeted marketing, and superior customer service, ultimately creating a competitive edge in the market.

- Improved financial forecasting: CLV provides valuable information for financial forecasting and budgeting. By estimating the future revenue potential of customers, businesses can make more accurate revenue projections and allocate budgets accordingly.

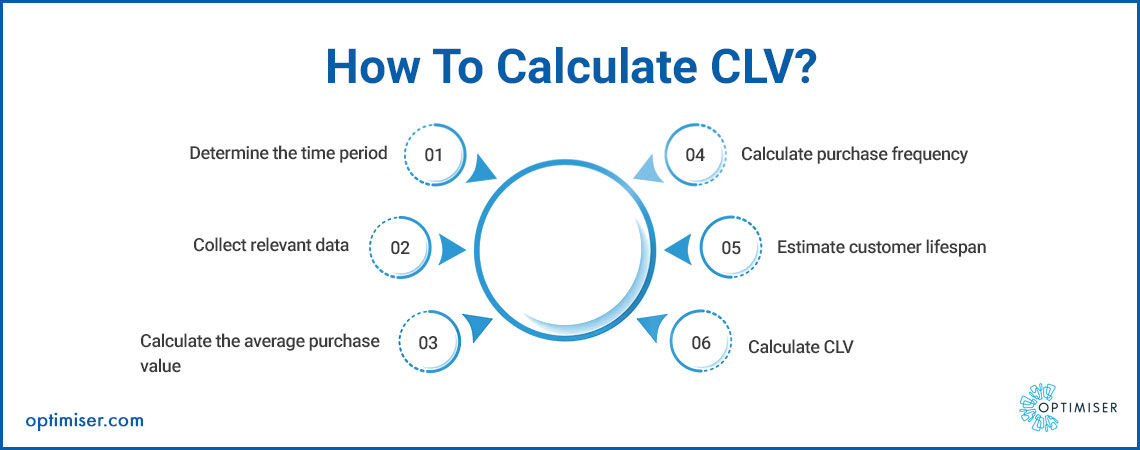

How To Calculate CLV In Six Easy Steps?

Step 1: Define the timeframe

Determine the timeframe you want to consider for calculating CLV. It could be months, years, or any other suitable period depending on your business and industry.

Step 2: Calculate the average purchase value

Calculate the average purchase value by dividing the total revenue generated from a customer by the number of purchases they made during the defined timeframe. This gives you an estimate of how much a customer spends on average per purchase.

Average Purchase Value = Total Revenue / Number of Purchases

Step 3: Calculate the average purchase frequency

Determine the average purchase frequency by dividing the total number of purchases made by the customer by the length of the defined timeframe. This provides the average number of times a customer makes a purchase within the specified period.

Average Purchase Frequency = Total Number of Purchases / Length of Timeframe

Also Read: Maximising Profitability: The Power Of AI In Sales

Step 4: Calculate customer lifespan

Determine the average lifespan of a customer by calculating the length of time they remain active and make purchases. This can be derived by analyzing historical customer data or by using customer churn rates (the rate at which customers stop purchasing).

Customer Lifespan = 1 / Customer Churn Rate

Step 5: Calculate customer value

Calculate the customer value by multiplying the average purchase value by the average purchase frequency. This represents the total value generated by a customer within the defined timeframe.

Customer Value = Average Purchase Value * Average Purchase Frequency

Step 6: Calculate CLV

Finally, calculate the Customer Lifetime Value by multiplying the customer value by the customer lifespan. This gives an estimate of the total value a customer is expected to bring over their lifetime.

CLV = Customer Value * Customer Lifespan

Optimiser CRM With Analytics For Business Growth

Optimiser web based CRM with analytics can significantly contribute to business growth. By leveraging analytics on the platform, businesses can gain valuable insights into customer behaviour, preferences, and trends. These insights enable targeted marketing campaigns, personalised customer experiences, and improved customer retention strategies. Analytics tracked through the Optimiser dashboard can help identify high-value customers, optimise sales and marketing efforts, and identify areas for improvement. It allows businesses to make data-driven decisions, enhance customer satisfaction, and drive revenue growth. By using Optimiser CRM, businesses can unlock the full potential of their customer data and drive sustainable business growth.

Summary

CLV is an ongoing process, and the calculations should be regularly reviewed and updated as customer behaviours and business dynamics evolve. The more data and insights businesses have, the more accurate their CLV calculations will be, allowing them to make informed decisions regarding marketing strategies, customer acquisition, and retention efforts.

30 days free trial. No credit card required

One powerful platform

One powerful platform

Simple to use

Simple to use

Comprehensive

Comprehensive